Disclaimer: This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice.

GOOGL (Alphabet Inc)

Ticker: GOOGL

Bias: Bullish continuation

GOOGL is displaying a clean, high-confidence bullish structure across multiple timeframes, signaling strength and potential upside continuation.

Thesis Summary

GOOGL continues to indicate trend strength, volume growth, and strong support, making it a technically sound setup for a bullish continuation. Trend strength + support confluence = favorable risk-reward for trend-following traders. Note that a sustained breakdown below $300 or loss of the 20-day moving average would weaken the bullish thesis and warrant reassessment.

🎯 Suggested Trade Levels (for reference only)

Entry: $313.50

Stop-Loss: $310.45

Target: $323 – $326

Levels are based on current technical structure and support/resistance zones. Manage risk accordingly.

Key Technical Signals

Bullish Daily Close: The most recent daily candle closed green, confirming short-term buying pressure and momentum.

Above 20-Day Moving Average: Price is holding above the 20-day moving average, reinforcing short-term trend strength and acting as dynamic support.

Multi-Timeframe Alignment: Both daily and weekly trends are strong and trending upward, a powerful signal that institutional momentum is aligned across timeframes.

Strong Structural Support at $300: The $300 level is acting as a major support zone, providing a clear technical floor and favorable risk definition.

Weekly Up Gap Support: A prior weekly upside gap remains unfilled, adding another layer of demand and reinforcing the bullish structure.

Expanding Relative Volume: Larger relative daily volume suggests accumulation rather than weak, low-liquidity price movement.

Higher Highs & Higher Lows: Classic uptrend behavior remains intact, confirming trend continuation rather than exhaustion.

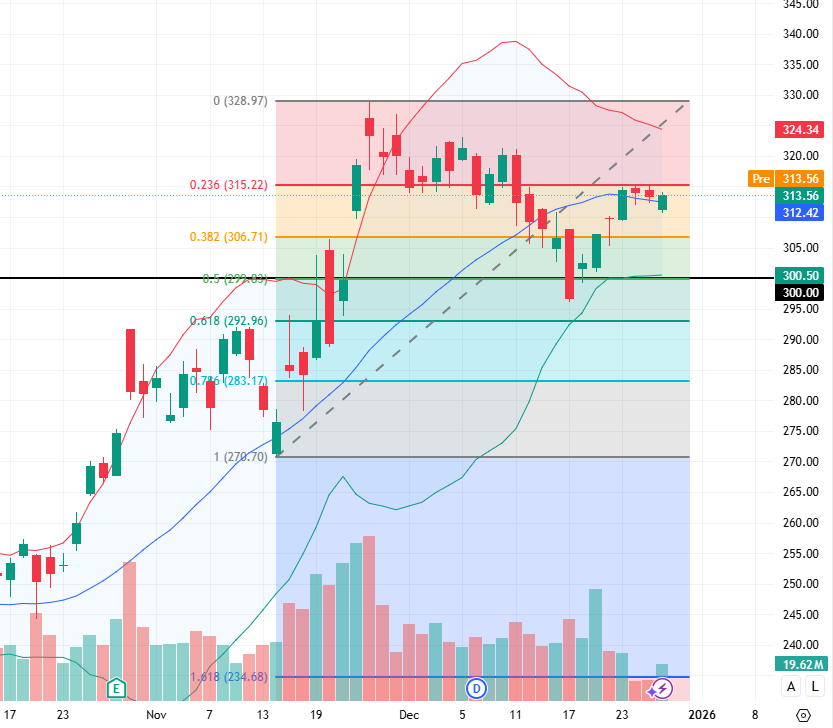

1-Day GOOGL Chart

GOOGL opened below the 20-day MVA but bulls quickly took control, pushing price higher and closing the day above this key level. The 20-day MVA now acts as support, and increased relative volume confirms strong buying interest.

1-Day GOOGL Chart, TradingView

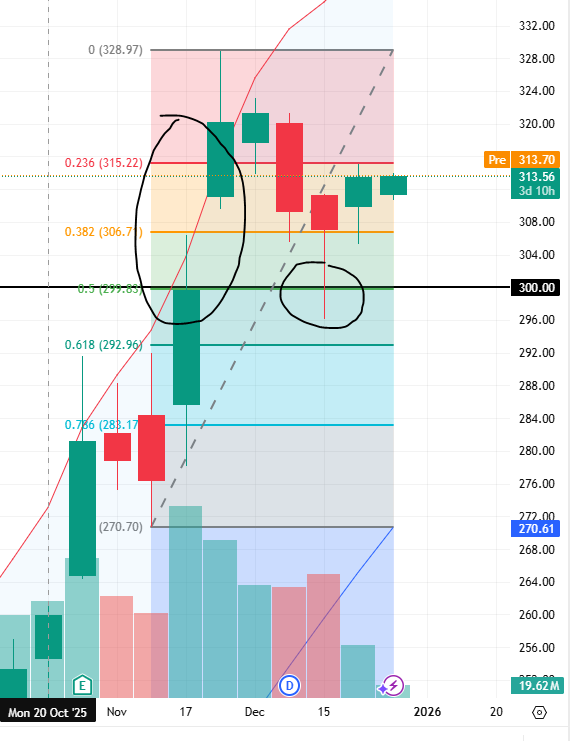

1-Week GOOGL Chart

On the weekly chart, the two-period up gap (circled in black) was successfully retested, forming a long-wick pin bar that signaled rejection of lower prices. Following the gap, price pulled back to the $300 level but failed to close the gap window. As a result, the up gap now acts as a strong support zone, reinforced by confluence with the $300 price level.

1-Week GOOGL Chart, TradingView

Sentiment Analysis Summary

Recent news regarding GOOGL over the past seven days has been predominantly bullish. Below are the key sentiment signals supporting this view:

Swedbank AB and other institutional investors have raised their stake in Alphabet Inc., indicating strong confidence in the company's future performance.

Alphabet's Gemini AI has gained significant market share, indicating successful products and a competitive edge against rivals like OpenAI's ChatGPT.

Alphabet has recently announced a quarterly dividend of $0.21 per share, indicating a commitment to returning value to shareholders amidst substantial capital expenditures for AI.

The stock's recent strong performance is influenced by substantial Q3 earnings that beat analysts' expectations, reinforcing confidence in Alphabet's operational efficiency.

Fundamental Analysis Summary

GOOGL appears to be in a strong position with positive growth in assets, equity, and net income. However, rising debt servicing costs and decreasing cash holdings are potential challenges that could affect short-term liquidity. Overall, the sentiment remains bullish, driven by strong operational performance and profitability metrics. Below are the key fundamental signals supporting this view:

The cash flow from operations is trending positively and may contribute to revenue stability.

Total assets increased steady growth over the last twelve months.

Operations generated a strong cash flow increase, indicating operational efficiency.

Strong revenues and net income growth.

Shareholders equity shows strong growth.