Disclaimer: This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice.

OHI (Omega Healthcare Investors, Inc.)

Ticker: OHI

Bias: Bullish trend continuation

OHI is presenting a constructive pullback within a broader uptrend, offering a technically favorable re-entry opportunity aligned with higher-timeframe momentum.

Thesis Summary

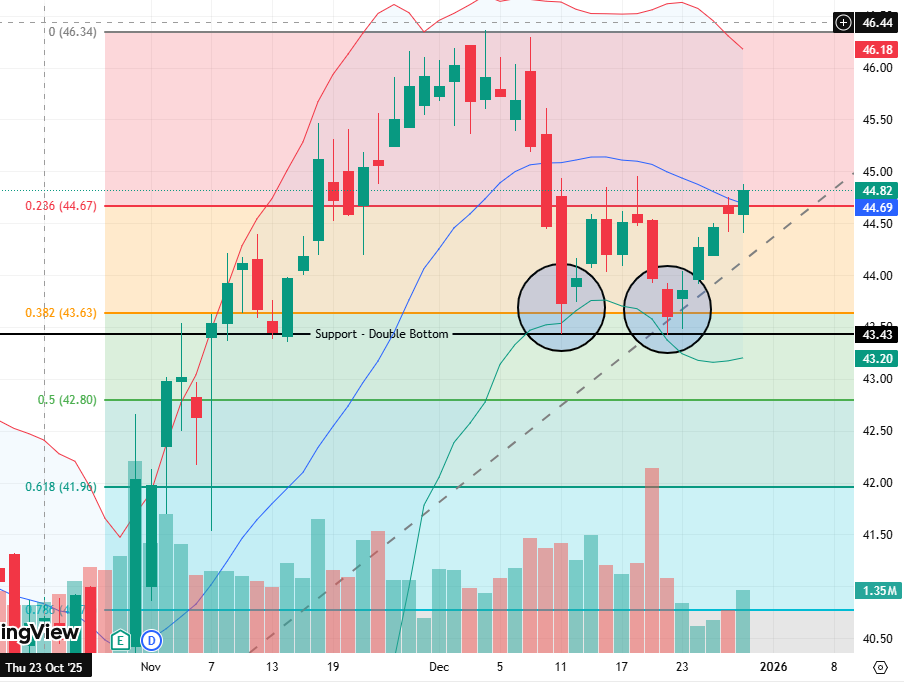

OHI’s pullback into a double bottom + Fibonacci support zone, followed by a price break above the 20-day MVA with relatively higher volume to support the move, suggests buyers are stepping back in. With daily and weekly trends still pointed higher, this setup favors bullish trend continuation as long as key support levels hold. Support + volume + trend alignment = higher-probability continuation setup.

🎯 Suggested Trade Levels (for reference only)

Entry: $44.80

Stop-Loss: $44.35

Target: $46.15

Levels are based on current technical structure and support/resistance zones. Manage risk accordingly.

Key Technical Signals

Double Bottom Support at $43.44: Price established a clear double bottom at $43.44, forming a strong base and confirming buyer interest at this level.

Fibonacci Confluence: The recent retracement from the $46.36 high found support near the 0.382 Fibonacci retracement, adding confluence to the $43–$44 support zone.

Price broke above 20-Day MVA: The latest daily candle closed green and back above the 20-day moving average, signaling short-term strength and a potential trend resumption.

Price broke above 0.236 Fib level: The latest daily candle broke above the 0.236 Fibonacci retracement level, providing a new support alongside the 20-day MVA.

Rising Volume Profile: Daily volume has increased steadily over the past four sessions, indicating improving participation.

Volume Confirmation on Break: Larger volume on the latest day supports the validity of the price break above the 20-day MVA and 0.236 Fib level and reduces the likelihood of a false breakout.

Multi-Timeframe Trend Alignment: Both daily and weekly trends remain firmly to the upside, reinforcing the broader bullish structure.

Healthy Pullback, Not Breakdown: The recent pullback from highs appears corrective rather than impulsive, providing a favorable risk-reward opportunity to re-enter the dominant uptrend.

Daily Chart Analysis (1D)

OHI opened below the 20-day moving average but buyers stepped in quickly, driving price higher and closing the session above this key level. Price also finished above the 0.236 Fibonacci retracement, creating a confluence of support. The 20-day MVA, Fibonacci level, and Double Bottom pattern now act as strong support, with increased relative volume confirming strong buying interest.

OHI | 1D Chart (TradingView)

Weekly Chart Analysis (1W)

The weekly chart shows a double bottom forming at a prior relative high, confirming strong support. The broader weekly trend remains clearly upward, and the recent pullback offers an opportunity to re-enter the trend with tighter risk near newly established support levels.

OHI | 1W Chart (TradingView)

Sentiment Analysis Summary

Overall, the sentiment for OHI appears largely positive, driven by strong institutional interest, favorable earnings reports, and insider confidence. However, concerns regarding the sustainability of dividends due to a high payout ratio might temper some bullish views. As the company navigates its operational challenges while maintaining a solid financial footing, it presents a mixed but cautiously optimistic outlook. Below are the key sentiment signals supporting this view:

Institutional investors have shown a strong interest in Omega Healthcare, with significant new investments from firms like HBK Sorce Advisory and Hudson Bay Capital Management, indicating confidence in the stock's potential.

Analyst ratings remain favorable, with a 'Moderate Buy' consensus and an average price target around $46.44, suggesting that market sentiments are generally optimistic.

Aging demographics and the push for high-quality healthcare operators emphasize the crucial role of operator selection for Omega's financial performance.

The stock recently hit an all-time high, demonstrating strong market performance and investor interest over the past year.

Fundamental Analysis Summary

Overall, OHI shows positive growth indicators, particularly in assets, equity, and net income. However, potential risks from high levels of debt and retained earnings deficits warrant cautious optimism as the company navigates its operational strategies. Below are the key fundamental signals supporting this view:

Total Assets grew by 10.70%, indicating effective growth strategies.

Shareholders Equity Increased by 19.68%, which suggests improving net worth.

Net Cash Flow from Operations is up by 27.93%, indicating strong cash generation from core operations.

Net Income increased by 54.80%, showing strong profitability improvements.