Disclaimer: This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice.

JNJ (Johnson & Johnson)

Ticker: JNJ

Bias: Bullish trend continuation

Strategy: Trend-following + mean reversion

Johnson & Johnson is showing a high-confidence bullish reversal at key support, positioning the stock for potential continuation within its broader daily uptrend.

Thesis Summary

JNJ formed a rare, high-quality bullish pin bar formed at the $205 support level, signaling strong rejection of lower prices and confirming buyer control at a key swing low. With price breaking above the 20-day SMA, daily volume increasing, and the broader daily uptrend intact, the recent pullback from the $215.19 high appears corrective, which sets up a favorable re-entry for a bullish trend continuation setup.

🎯 Suggested Trade Levels (for reference only)

Entry: $207.35

Stop-Loss: $204.95

Target: $214.55

Levels are based on current technical structure and support/resistance zones. Manage risk accordingly.

Key Technical Signals

Rare Bullish Pin Bar at Key Support ($205): A very strong and rare bullish pin bar formed with no upper wick, a small real body, and an exceptionally long lower wick, signaling aggressive rejection of lower prices and strong buyer dominance.

Swing Low Rejection at Prior Support: The pin bar printed precisely at the bottom of a swing low and bounced cleanly off a well-defined prior support level near $205, reinforcing this zone as a high-confidence demand area.

20-Day SMA Cross: The latest daily candle closed back above the 20-day SMA, indicating that price has regained short-term trend support after the pullback.

Primary Daily Uptrend Intact: The daily chart remains in a clear overall uptrend, with the recent pullback appearing corrective rather than structural.

Pullback from $215.19 High: Price pulled back from the $215.19 high, providing a favorable re-entry opportunity within the broader uptrend rather than a late-stage breakout chase.

Bullish Close Confirms Higher Low: The most recent daily close finished above the prior close, confirming the formation of a new relative low and validating the bullish rejection.

Increasing Volume Confirms Participation: Daily volume continues to trend higher, with the latest trade volume exceeding the past five trading periods—supporting the strength and legitimacy of the move.

Failed Breakdown Signals Bulls in Control: Price attempted to push lower but was aggressively bought up, resulting in a picture-perfect pin bar and clear evidence that bulls have regained control at support.

Higher Timeframe Trend Confluence: The broader weekly trend remains strong and firmly to the upside, providing higher-timeframe trend confluence that reinforces the bullish daily reversal and supports trend continuation potential.

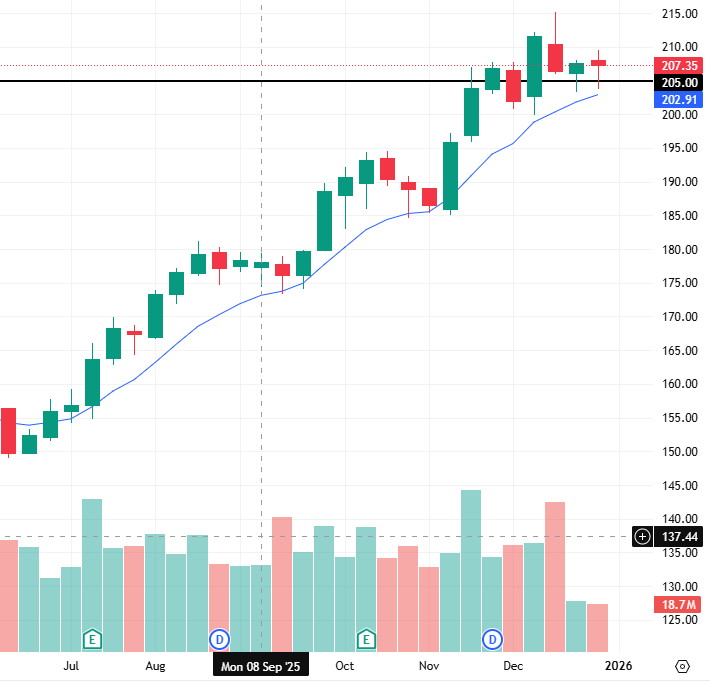

Daily Chart Analysis (1D)

JNJ | 1D Chart (TradingView)

The JNJ daily chart shows price rejecting the $205 support zone with a rare, high-quality bullish pin bar, followed by a strong close back above the 20-day SMA. With higher lows forming, rising volume, and the broader uptrend intact, the structure favors continuation after a healthy pullback from the $215.19 high.

Weekly Chart Analysis (1W)

JNJ | 1W Chart (TradingView)

The weekly chart remains in a strong, well-defined uptrend, with price holding above key long-term support and structure remaining bullish. Higher highs and higher lows continue to print, providing higher-timeframe confirmation and reinforcing the bullish setup seen on the daily chart.

Sentiment Analysis Summary

The overall sentiment surrounding Johnson & Johnson appears to be overwhelmingly bullish, evidenced by consistent dividend payments, recent acquisitions enhancing their product portfolio, and strong institutional support. Analysts are optimistic about J&J's revenue growth and the company's strategic focus on innovative medicine and oncology. Despite some concerns regarding earnings dilution from acquisitions, the general outlook remains positive as J&J navigates the challenges in the healthcare sector. Below are the key sentiment signals supporting this view:

Johnson & Johnson has once again announced a $1.30 per share quarterly dividend, marking 64 consecutive years of dividend increases.

Barclays increased its price target for J&J stock from $197 to $217, highlighting strong growth potential in their pharmaceutical franchises.

Ethic Inc. and Constitution Capital LLC have significantly increased their stakes in Johnson & Johnson, indicating strong institutional confidence.

Analyst consensus gives Johnson & Johnson a 'Moderate Buy' rating, reflecting confidence in the stock's performance moving forward.

Johnson & Johnson remains a recommended dividend-paying stock for long-term investment, showcasing resilience in the healthcare sector.

Overall, J&J maintains a high institutional ownership of 69.55%, indicating strong belief in its long-term value from major investors.

Fundamental Analysis Summary

Considering the growth in net income and assets, coupled with prudent management of equity, Johnson & Johnson is in a solid position. However, the increase in debt and decrease in cash reserves warrant close monitoring to ensure the company's long-term stability and liquidity. Overall, the outlook remains bullish for the upcoming year. Below are the key fundamental signals supporting this view:

Total assets have shown a consistent uptick, indicating good growth and an expanding base.

A sustained increase in shareholders' equity suggests strengthening financial health and increased net worth.

Significant growth in net income indicates improved profitability.

Continuous growth in EBIT shows strong operational efficiency.

Consistent increases in gross profit suggest effective revenue management and cost control.

Brainlet Meme of the Day!

Remember: Protect your capital, the best loser wins.

Market tuition is expensive. These guys paid full price.

Wall Street thanks them for their service. 💀

Liquidity providers spotted.

Thank you for being a Stocksift subscriber!

We hope you enjoyed this issue!

Best,

The Stocksift Team